s corp dividend tax calculator

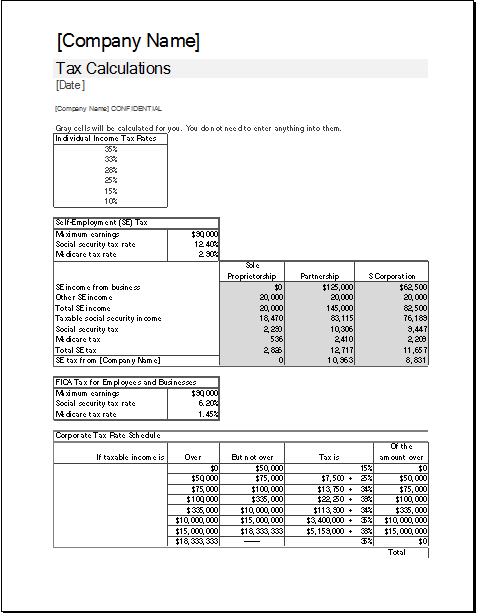

The dividend tax rates for dividends that exceed the set allowance are. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800.

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

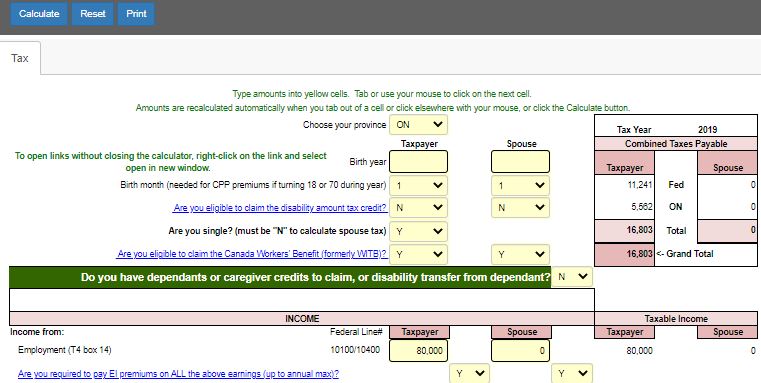

Scroll down for some further advice on choosing the most tax-efficient salary plus some explanatory notes.

. Use our calculator to work out how much tax you will incur on any combination of salary and dividends. Dividend Tax Rates for the 2021 Tax Year. However even if you get a Schedule K-1 you will get a 1099-DIV reporting the dividends.

Annual cost of administering a payroll. You should pay this via a Self Assessment by 31st January following the end of the tax year you earned them. Income is taxed only once when the income is earned by the S corporation whether the income is reinvested or distributed.

Before using the calculator you will need to. Person A would receive 25000 in distributions. Enter your salarydividend amounts into the yellow boxes below and simply refresh the page if you make a mistake.

Unlike partnerships S corporations are not. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. Not done a Self Assessment tax return before.

2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder level. Normally these taxes are withheld by your employer. Dividend Tax Rates for the 2021 Tax Year.

A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited Partnership. 765 153 Employees Tax Burden Employers Tax Burden VIEW CALCULATOR Being Taxed as an S-Corp Versus LLC If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. The S corporation will issue a shareholder a Schedule K-1.

S corp dividend tax calculator Tuesday March 1 2022 Edit. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the Higher Rate band of 40 3935 of Dividend Income. Say for example that you get 125000 of income from an S corporation.

Enter the estimated yearly net income for the business. A non-dividend distribution in excess of stock basis is taxed as a capital gain on the shareholders personal return. If income is standard income you would pay the standard income tax rates.

0 12570 0 personal allowance 12571 50270 75. If an S corp allocates 125000 profit to you the shareholder the character of such income is important. Say for example that you get 125000 of income from an S corporation.

Calculate Your Take Home Pay Enter gross salary Enter dividends Your Total Income - Your Total Taxable Income - Tax on salary - Employees NIC paid by you -. Person C would receive 10000 in distributions. Our salary and dividend tax calculator calculates tax payable on dividends and you can use it to calculate how much tax youll pay on the dividends youll earn in the current tax year.

For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. Not sure what your reasonable salary is. If you earn over 150000 or more across all sources of income you pay 3935 tax on the dividends you earn over 2000 per tax year.

The tax rate on nonqualified dividends. Dividend income is taxed as follows. 50000 of ordinary business profits 50000 of long-term capital gains on some investments the S corporation sold.

If the income is considered capital gains or dividends you would pay a lower tax rate ranging from 0 percent to 20 percent. Determine a reasonable salary for the work you do by comparing similar salaries on websites like Glassdoor or the US Bureau of Labor Statistics. This tax calculator shows these values at the top of your results.

How much can I save. Enter the salary you would pay yourself if an S-Corporation. We have used this code in our calculations.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. Heres a quick video to explain what its all about.

In 2022-23 these rates will all increase by 125 percentage points. Estimate your net profit for the tax year. Person B would receive 15000 in distributions.

Its also possible you get a Schedule K-1 if you invest in a fund or exchange-traded fund ETF ETF that operates as a partnership. Annual state LLC S-Corp registration fees. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800.

Our calculator will estimate whether electing S corp will result in a tax win for your business. If income is standard income you would pay the standard income tax rates. Estimated Local Business tax.

It is a long-term capital gain LTCG if the S corporation stock has been held for longer than one year. Person A would receive 25000 in distributions. If an S.

Our calculator will estimate whether electing S corp will result in a tax win for your business. Non-deductible expenses reduce a shareholders stock andor debt basis before loss and deduction items. Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to begin.

Or other income from a trust estate partnership LLC or S corporation. But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes 0 usually 15 and worst-case 20. Total first year cost of.

If income is standard income you would pay the standard income tax rates. How your dividend tax is calculated.

How The Dividend Tax Credit Works

Part Iv Tax And The Refundable Dividend Tax On Hand Cpa In Toronto

Dividend Tax Calculator Taxscouts

S Corp Vs Llc Difference Between Llc And S Corp Truic

Domni Crizantemă Bibliografie Limited Company Tax Calculator Schwarzwald Hotel Org

S Corp Vs Llc Difference Between Llc And S Corp Truic

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Dividend Gross Up And A Dividend Tax Credit Mechanism

Dividend Tax Calculator 2022 23

Taxtips Ca 2019 Canadian Income Tax And Rrsp Savings Calculator

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

Should You Move To A State With No Income Tax Forbes Advisor

Domni Crizantemă Bibliografie Limited Company Tax Calculator Schwarzwald Hotel Org

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Dividend Tax Calculator 2021 22

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Domni Crizantemă Bibliografie Limited Company Tax Calculator Schwarzwald Hotel Org